Embark on a journey of understanding the intricacies of private health plans from Cigna. This guide offers valuable insights and practical tips to help you navigate the realm of healthcare coverage with confidence and clarity.

Delve into the details of enrollment, coverage, benefits, and cost management to make informed decisions tailored to your individual needs.

Understanding Private Health Plans from Cigna

Private health plans offered by Cigna come with a range of features designed to provide comprehensive coverage and benefits to policyholders.

Key Features of Cigna’s Private Health Plans

- Personalized healthcare solutions tailored to individual needs

- Access to a wide network of healthcare providers and facilities

- Coverage for preventive care, prescription drugs, hospital stays, and more

- Options for additional benefits such as dental, vision, and mental health services

Overview of Coverage and Benefits

Cigna's private health plans offer coverage for a variety of medical services, including:

- Primary care visits

- Specialist consultations

- Diagnostic tests and imaging

- Surgical procedures

- Emergency care

Differences from Other Types of Insurance

Private health plans from Cigna differ from other types of insurance, such as employer-sponsored plans or government-funded programs, in several ways:

- Policyholders have more control over their healthcare choices and providers

- Plans offer more flexibility in terms of coverage options and benefits

- Individuals can customize their plans based on their specific healthcare needs

Navigating Cigna’s Private Health Plans

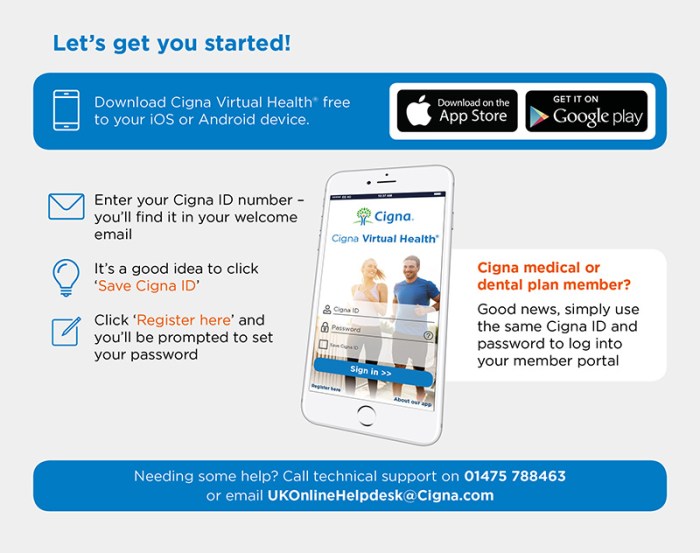

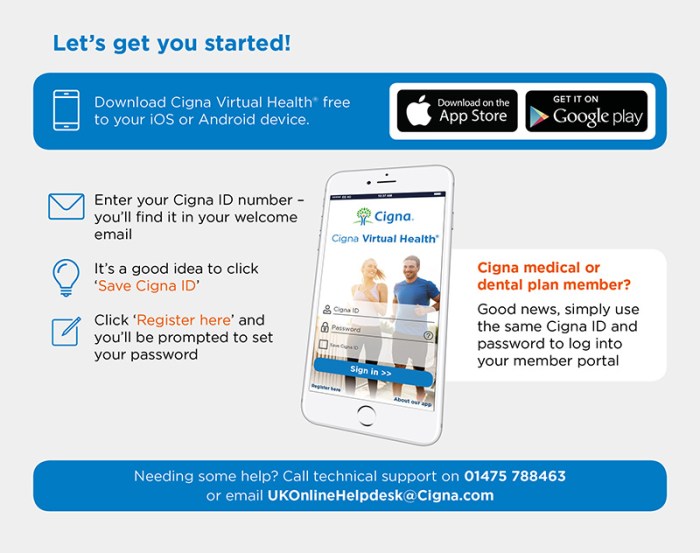

Enrolling in a private health plan from Cigna is a straightforward process that can be done online, over the phone, or through an agent. Here's how you can get started:

Choosing the Right Private Health Plan

When selecting a private health plan from Cigna, it's essential to consider your individual needs and preferences. Here are some tips to help you make the right choice:

- Assess your healthcare needs: Determine what type of coverage you require based on your medical history, current health status, and any ongoing conditions.

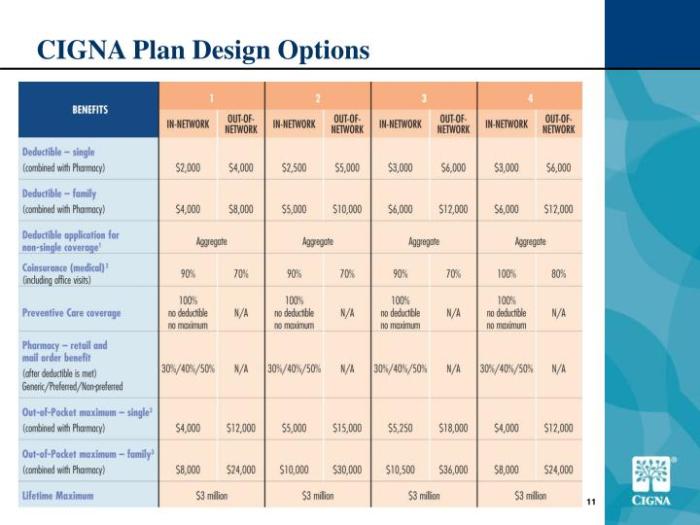

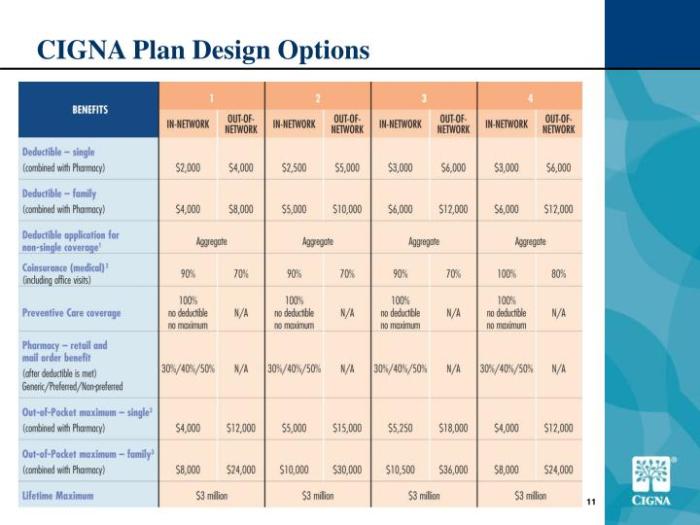

- Compare plan options: Cigna offers a variety of private health plans with different coverage levels and premiums. Compare the options available to find one that aligns with your needs.

- Consider your budget: Evaluate the cost of premiums, deductibles, and copayments to ensure that the plan you choose is affordable for you.

- Check network providers: Make sure that your preferred healthcare providers, hospitals, and facilities are included in Cigna's network to access quality care.

- Review additional benefits: Look into any extra features or benefits offered by Cigna, such as wellness programs, telehealth services, or prescription drug coverage.

Network of Healthcare Providers and Facilities

Cigna's private health plans come with a wide network of healthcare providers and facilities to ensure you have access to quality care. Here's what you need to know:

| Provider Types | Coverage |

|---|---|

| Primary Care Physicians | Comprehensive coverage for routine check-ups and preventive care. |

| Specialists | Access to a diverse range of specialists for specialized medical treatment. |

| Hospitals | In-network hospitals for inpatient and outpatient services, surgeries, and emergency care. |

Choosing a private health plan from Cigna that includes your preferred healthcare providers can help you receive the care you need when you need it.

Utilizing Benefits and Services

When it comes to Cigna's private health plans, there are various additional services and benefits that can help you make the most out of your coverage.

Preventive Care Services

Preventive care services are crucial for maintaining your health and well-being. With Cigna's private health plans, you can take advantage of services such as:

- Annual check-ups and screenings

- Immunizations and vaccinations

- Health education and counseling

Accessing Mental Health Services

It's important to prioritize your mental health just as much as your physical health. Under Cigna's private health plans, you can access mental health services through:

- Coverage for therapy sessions

- Access to psychiatrists and psychologists

- Support for substance abuse treatment

Specialized Care Services

For specialized care needs, Cigna's private health plans offer access to a range of services tailored to your specific health conditions, including:

- Referrals to specialists for complex medical issues

- Coverage for diagnostic tests and procedures

- Coordination of care for chronic conditions

Managing Costs and Claims

Managing the costs associated with private health plans from Cigna is essential to ensure you are maximizing your benefits while minimizing out-of-pocket expenses. Understanding the cost structure, deductibles, copayments, and premiums can help you effectively manage your healthcare expenses.

Cost Structure of Cigna’s Private Health Plans

- Premiums: Premiums are the monthly payments you make to maintain your health insurance coverage with Cigna.

- Deductibles: Deductibles are the amount you must pay out of pocket before your insurance kicks in to cover costs.

- Copayments: Copayments are fixed amounts you pay for covered services at the time of service, often varying based on the type of service.

Managing and Reducing Out-of-Pocket Costs

- Utilize In-Network Providers: Choose healthcare providers within Cigna's network to benefit from lower negotiated rates.

- Understand Coverage Details: Familiarize yourself with your plan's coverage details to avoid unexpected expenses.

- Utilize Preventive Care: Take advantage of free preventive care services to maintain your health and avoid costly treatments down the line.

- Explore Prescription Drug Options: Opt for generic medications and mail-order prescriptions to save on drug costs.

Filing and Tracking Claims with Cigna

- Submit Claims Promptly: Make sure to submit claims for covered services in a timely manner to avoid delays in reimbursement.

- Track Claims Online: Use Cigna's online portal to track the status of your claims and ensure they are processed correctly.

- Keep Records: Maintain copies of all communications and paperwork related to claims to resolve any discrepancies efficiently.

Wrap-Up

As we reach the end of our exploration into navigating private health plans from Cigna, we hope you feel empowered to make well-informed choices regarding your healthcare coverage. Armed with knowledge and guidance, you can confidently navigate the complexities of private health plans with ease.

Top FAQs

How do I enroll in a private health plan from Cigna?

To enroll in a private health plan from Cigna, you can visit their website or contact their customer service for guidance through the enrollment process.

What are the key differences between private health plans and other types of insurance offered by Cigna?

Private health plans typically offer more comprehensive coverage compared to other insurance types like short-term plans, focusing on long-term health needs.

How can I reduce out-of-pocket costs with Cigna's private health plans?

You can reduce out-of-pocket costs by choosing in-network providers, utilizing preventive care services, and understanding your plan's coverage details.

What additional services or benefits may come with Cigna's private health plans?

Additional services may include telehealth options, wellness programs, and discounts on certain health-related products or services.

Embark on a journey of understanding the intricacies of private health plans from Cigna. This guide offers valuable insights and practical tips to help you navigate the realm of healthcare coverage with confidence and clarity.

Delve into the details of enrollment, coverage, benefits, and cost management to make informed decisions tailored to your individual needs.

Understanding Private Health Plans from Cigna

Private health plans offered by Cigna come with a range of features designed to provide comprehensive coverage and benefits to policyholders.

Key Features of Cigna’s Private Health Plans

- Personalized healthcare solutions tailored to individual needs

- Access to a wide network of healthcare providers and facilities

- Coverage for preventive care, prescription drugs, hospital stays, and more

- Options for additional benefits such as dental, vision, and mental health services

Overview of Coverage and Benefits

Cigna's private health plans offer coverage for a variety of medical services, including:

- Primary care visits

- Specialist consultations

- Diagnostic tests and imaging

- Surgical procedures

- Emergency care

Differences from Other Types of Insurance

Private health plans from Cigna differ from other types of insurance, such as employer-sponsored plans or government-funded programs, in several ways:

- Policyholders have more control over their healthcare choices and providers

- Plans offer more flexibility in terms of coverage options and benefits

- Individuals can customize their plans based on their specific healthcare needs

Navigating Cigna’s Private Health Plans

Enrolling in a private health plan from Cigna is a straightforward process that can be done online, over the phone, or through an agent. Here's how you can get started:

Choosing the Right Private Health Plan

When selecting a private health plan from Cigna, it's essential to consider your individual needs and preferences. Here are some tips to help you make the right choice:

- Assess your healthcare needs: Determine what type of coverage you require based on your medical history, current health status, and any ongoing conditions.

- Compare plan options: Cigna offers a variety of private health plans with different coverage levels and premiums. Compare the options available to find one that aligns with your needs.

- Consider your budget: Evaluate the cost of premiums, deductibles, and copayments to ensure that the plan you choose is affordable for you.

- Check network providers: Make sure that your preferred healthcare providers, hospitals, and facilities are included in Cigna's network to access quality care.

- Review additional benefits: Look into any extra features or benefits offered by Cigna, such as wellness programs, telehealth services, or prescription drug coverage.

Network of Healthcare Providers and Facilities

Cigna's private health plans come with a wide network of healthcare providers and facilities to ensure you have access to quality care. Here's what you need to know:

| Provider Types | Coverage |

|---|---|

| Primary Care Physicians | Comprehensive coverage for routine check-ups and preventive care. |

| Specialists | Access to a diverse range of specialists for specialized medical treatment. |

| Hospitals | In-network hospitals for inpatient and outpatient services, surgeries, and emergency care. |

Choosing a private health plan from Cigna that includes your preferred healthcare providers can help you receive the care you need when you need it.

Utilizing Benefits and Services

When it comes to Cigna's private health plans, there are various additional services and benefits that can help you make the most out of your coverage.

Preventive Care Services

Preventive care services are crucial for maintaining your health and well-being. With Cigna's private health plans, you can take advantage of services such as:

- Annual check-ups and screenings

- Immunizations and vaccinations

- Health education and counseling

Accessing Mental Health Services

It's important to prioritize your mental health just as much as your physical health. Under Cigna's private health plans, you can access mental health services through:

- Coverage for therapy sessions

- Access to psychiatrists and psychologists

- Support for substance abuse treatment

Specialized Care Services

For specialized care needs, Cigna's private health plans offer access to a range of services tailored to your specific health conditions, including:

- Referrals to specialists for complex medical issues

- Coverage for diagnostic tests and procedures

- Coordination of care for chronic conditions

Managing Costs and Claims

Managing the costs associated with private health plans from Cigna is essential to ensure you are maximizing your benefits while minimizing out-of-pocket expenses. Understanding the cost structure, deductibles, copayments, and premiums can help you effectively manage your healthcare expenses.

Cost Structure of Cigna’s Private Health Plans

- Premiums: Premiums are the monthly payments you make to maintain your health insurance coverage with Cigna.

- Deductibles: Deductibles are the amount you must pay out of pocket before your insurance kicks in to cover costs.

- Copayments: Copayments are fixed amounts you pay for covered services at the time of service, often varying based on the type of service.

Managing and Reducing Out-of-Pocket Costs

- Utilize In-Network Providers: Choose healthcare providers within Cigna's network to benefit from lower negotiated rates.

- Understand Coverage Details: Familiarize yourself with your plan's coverage details to avoid unexpected expenses.

- Utilize Preventive Care: Take advantage of free preventive care services to maintain your health and avoid costly treatments down the line.

- Explore Prescription Drug Options: Opt for generic medications and mail-order prescriptions to save on drug costs.

Filing and Tracking Claims with Cigna

- Submit Claims Promptly: Make sure to submit claims for covered services in a timely manner to avoid delays in reimbursement.

- Track Claims Online: Use Cigna's online portal to track the status of your claims and ensure they are processed correctly.

- Keep Records: Maintain copies of all communications and paperwork related to claims to resolve any discrepancies efficiently.

Wrap-Up

As we reach the end of our exploration into navigating private health plans from Cigna, we hope you feel empowered to make well-informed choices regarding your healthcare coverage. Armed with knowledge and guidance, you can confidently navigate the complexities of private health plans with ease.

Top FAQs

How do I enroll in a private health plan from Cigna?

To enroll in a private health plan from Cigna, you can visit their website or contact their customer service for guidance through the enrollment process.

What are the key differences between private health plans and other types of insurance offered by Cigna?

Private health plans typically offer more comprehensive coverage compared to other insurance types like short-term plans, focusing on long-term health needs.

How can I reduce out-of-pocket costs with Cigna's private health plans?

You can reduce out-of-pocket costs by choosing in-network providers, utilizing preventive care services, and understanding your plan's coverage details.

What additional services or benefits may come with Cigna's private health plans?

Additional services may include telehealth options, wellness programs, and discounts on certain health-related products or services.