Exploring the best commercial health insurance plan for you involves comparing Cigna with other major providers. This journey delves into key differences, network coverage, plan options, costs, and customer satisfaction to help you make an informed decision.

Overview of Cigna and other commercial providers

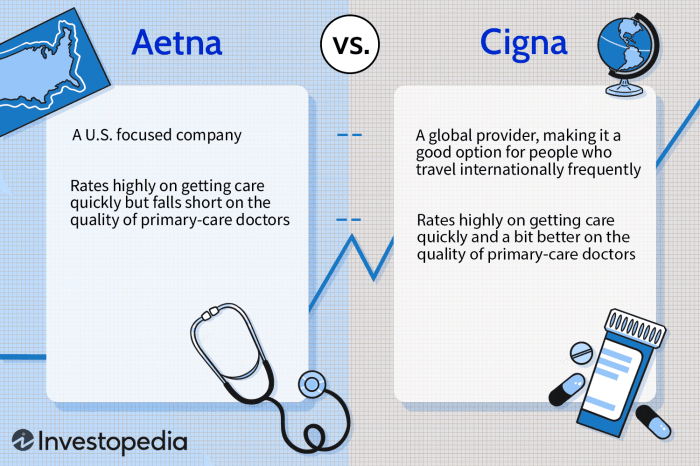

Cigna is a leading health services organization that offers a wide range of health insurance products and services to individuals and businesses. Other major commercial health insurance providers include UnitedHealthcare, Aetna, and Anthem.When comparing Cigna to other providers, there are several key differences to consider.

These differences can include coverage options, network size, premium costs, out-of-pocket expenses, and customer service quality. It's essential to evaluate these factors carefully to choose the right commercial plan that best suits individual needs.

List of key differences between Cigna and other providers

- Coverage options: Cigna may offer different coverage options compared to other providers, such as specific wellness programs or additional benefits.

- Network size: The size and scope of the provider network can vary, impacting access to healthcare providers and facilities.

- Premium costs: Premium costs for Cigna plans may differ from those of other providers, depending on the coverage and benefits offered.

- Out-of-pocket expenses: Deductibles, copayments, and coinsurance rates can vary between Cigna and other providers, affecting overall costs for healthcare services.

- Customer service quality: The level of customer service provided by Cigna and other providers can influence the overall experience of members.

Importance of choosing the right commercial plan for individual needs

Choosing the right commercial health insurance plan is crucial as it can impact access to quality healthcare, affordability of services, and overall satisfaction with the coverage. Individuals should carefully consider their healthcare needs, budget constraints, and preferences when selecting a plan to ensure they receive the necessary care and support when needed.

Network Coverage

When it comes to choosing a commercial health insurance plan, network coverage plays a crucial role in determining the accessibility and quality of healthcare services available to the insured individual. Let's explore the network coverage offered by Cigna and how it compares to other providers.

Cigna Network Coverage

Cigna boasts an extensive network of healthcare providers, including hospitals, clinics, and specialists across the country. Their network is known for its comprehensive coverage, ensuring that members have access to a wide range of healthcare services wherever they are located.

Other Providers Network Coverage

In comparison to Cigna, other commercial insurance providers may have varying sizes and scopes of provider networks. Some providers may have more limited networks, which could impact the availability of certain healthcare services or providers in specific regions.

Impact on Access to Healthcare Services

The size and scope of a provider network can significantly impact an individual's access to healthcare services. A larger network typically means more choices in terms of healthcare providers and services, offering flexibility and convenience to the insured individual. On the other hand, a smaller network may require members to travel further or seek out-of-network care, which can result in higher out-of-pocket costs.Overall, when considering commercial health insurance plans, it's essential to evaluate the network coverage offered by each provider to ensure that you have access to the healthcare services you need, where and when you need them.

Plan Options and Flexibility

When considering commercial health insurance plans, it is crucial to assess the various options available and the flexibility they offer. This can greatly impact the coverage and benefits you receive based on your individual needs and preferences.

Plan Options from Cigna and Other Providers

- Cigna offers a range of plan options, including HMO, PPO, EPO, and POS plans, each with different networks and coverage levels.

- Other providers may also offer similar plan types but with variations in network coverage, provider choices, and prescription drug benefits.

- Some providers may offer high-deductible health plans (HDHPs) coupled with Health Savings Accounts (HSAs) for added flexibility.

Flexibility in Plan Customization

- Cigna and other providers may allow for customization of coverage options, such as adding dental, vision, or mental health benefits to your plan.

- Providers may also offer the flexibility to choose between different deductible, copay, and coinsurance options to tailor the plan to your budget and healthcare needs.

- Some plans may provide the option to add on wellness programs, telehealth services, or prescription drug coverage for enhanced benefits.

Benefits of Flexible Commercial Plans

- Individuals with specific healthcare needs, such as chronic conditions or prescription medications, can benefit from customizing their plan to include the necessary coverage.

- Young, healthy individuals may opt for higher deductible plans with lower premiums to save on costs while still having essential coverage in place.

- The flexibility to add on additional benefits like dental or vision coverage can provide comprehensive healthcare solutions for individuals and their families.

Cost and Affordability

When comparing commercial health insurance plans like Cigna with other providers, it's essential to consider the cost and affordability aspect. Understanding the breakdown of costs associated with these plans can help you make an informed decision about which option best fits your budget and healthcare needs.

Premiums, Deductibles, Copays, and Out-of-Pocket Expenses

- Premiums: Premiums are the monthly amount you pay to maintain your health insurance coverage. Cigna and other commercial providers may offer different premium rates based on the level of coverage and services included in the plan.

- Deductibles: Deductibles refer to the amount you must pay out of pocket before your insurance coverage kicks in. Compare the deductibles of Cigna plans with other providers to see which plan offers a more manageable deductible for your budget.

- Copays: Copays are fixed amounts you pay for covered services, such as doctor visits or prescriptions. Consider the copay amounts for Cigna plans versus other providers to determine which plan aligns with your expected healthcare needs.

- Out-of-Pocket Expenses: Out-of-pocket expenses include any costs you incur beyond premiums, deductibles, and copays. This can include coinsurance, which is a percentage of the cost you pay for covered services. Evaluate the out-of-pocket expenses associated with Cigna plans and other providers to assess the overall affordability of each plan.

Factors Influencing Affordability

- Network Coverage: The size and scope of the provider network can impact the cost of commercial health insurance plans. Plans with larger networks may have higher premiums but offer more options for healthcare providers, while plans with smaller networks could be more cost-effective but limit your choices.

- Plan Options and Flexibility: The flexibility of plan options, such as the ability to choose between HMOs, PPOs, or EPOs, can influence the affordability of commercial health insurance. Consider whether you prioritize lower costs or greater flexibility in selecting healthcare providers and services.

- Healthcare Needs: Your individual healthcare needs, including chronic conditions, preventive care, or anticipated medical expenses, can impact the affordability of commercial health insurance plans. Review the coverage and benefits offered by Cigna and other providers to ensure they align with your specific healthcare requirements.

- Subsidies and Tax Credits: Depending on your income level and eligibility, you may qualify for subsidies or tax credits that reduce the cost of commercial health insurance plans. Explore these options to determine how they can enhance the affordability of Cigna plans or other provider offerings.

Customer Satisfaction and Reviews

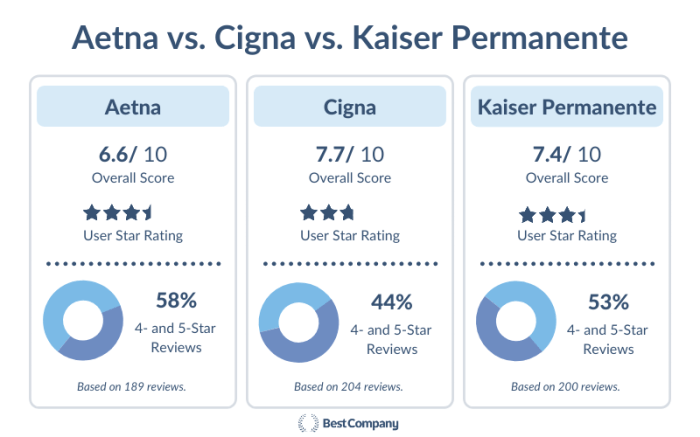

When it comes to choosing a commercial health insurance provider, customer satisfaction and reviews play a crucial role in determining the quality of service you can expect. Let's explore how Cigna and other commercial providers fare in terms of customer feedback.

Cigna

- Cigna generally receives positive reviews for its customer service, with many customers praising the helpfulness and efficiency of representatives.

- Customers have reported smooth claims processing experiences with Cigna, leading to high satisfaction levels.

- Overall, Cigna is known for its comprehensive coverage options and user-friendly online tools, contributing to a positive customer experience.

Other Commercial Providers

- Some other commercial providers may receive mixed reviews regarding customer service, with complaints about long wait times or unresponsive representatives.

- Claims processing issues can be a common point of frustration for customers of certain commercial providers, impacting overall satisfaction levels.

- While some providers offer competitive plan options, the lack of transparency or communication can lead to dissatisfaction among customers.

Summary

In conclusion, navigating the realm of commercial health insurance plans requires careful consideration of various factors. By understanding the nuances between Cigna and other providers, you can select a plan tailored to your unique needs and preferences.

Essential Questionnaire

What factors should I consider when choosing between Cigna and other providers?

When deciding on a commercial plan, factors to consider include network coverage, plan options, costs, and customer satisfaction ratings.

Does Cigna offer customizable coverage options?

Yes, Cigna provides various plan options that can be tailored to individual needs, offering flexibility in coverage.

How do customer satisfaction ratings for Cigna compare to other commercial providers?

Customer satisfaction ratings for Cigna are competitive, with positive feedback on service quality and claims processing efficiency.

What are some common factors that influence the affordability of commercial health insurance plans?

Factors influencing affordability include premiums, deductibles, copays, and out-of-pocket expenses, which vary among different providers.